Mr Exampleson owes 0 taxes this yr and can get an extra credit score of 210 on his 2022 tax return. 2022 and earlier than January 1.

Making use of For The Photo voltaic Tax Credit score Is As Simple As 123 Are Photo voltaic

Submitting necessities for the photo voltaic tax credit score.

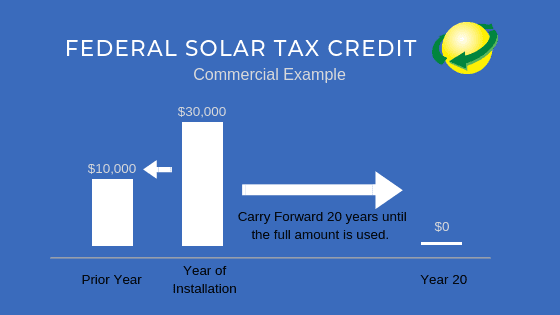

Irs photo voltaic tax credit score 2022 kind. The federal photo voltaic tax credit score performs a serious function in incentivizing householders to go photo voltaic. Nevertheless this quantity can’t exceed 6000 USD per taxpayer in a monetary yr. 2022 is the final yr for the complete 26 credit score.

Not solely are they making photo voltaic tasks extra accessible to folks however in addition they present reimbursements for photo voltaic tasks. Add any further power enchancment prices if any on traces 2 by 4. Value of a Photo voltaic System.

The photo voltaic tax credit score is at present accessible at a price of 26 by 2022 then at 22 for building tasks that start in 2023. He can also qualify for refundable tax credit on the second a part of. The credit score will nonetheless be accessible in 2023 however at a lowered price of twenty-two.

June 10 2022 June 9 2022. In case your tax legal responsibility for 2021 is 6000 you’ll get a full credit score and can owe simply 800. House owners of recent residential and business photo voltaic can deduct 26 % of the price of the system from their taxes.

The entire gross price of your photo voltaic power system after any money rebates. A Have been the certified power effectivity enhancements or residential power property prices in your primary dwelling situated in the US. To say a common enterprise credit score you’ll first must get the kinds you must declare your present yr enterprise credit.

About Publication 972 Youngster Tax Credit score. In the event you file a Type 1040 or 1040-SR Schedule C it’s possible you’ll be eligible to say the Earned Earnings Tax Credit score EITC. For installations accomplished till 2023 the tax credit score is 26 of photo voltaic prices.

Now the photo voltaic funding tax credit score is obtainable to householders in some kind by 2022. How a lot is the photo voltaic tax credit score. For instance in case your photo voltaic PV system was put in earlier than December 31 2022 price 18000 and your utility gave you a one-time rebate of 1000 for putting in the system your tax credit score could be calculated as follows.

The varied people who find themselves profiting from the suns power and the communities which might be making it simpler to go photo voltaic. The Photo voltaic ITC will help to considerably cut back the full price of a house photo voltaic system. The photo voltaic funding tax credit score is a dollar-for-dollar discount within the quantity of taxes you owe.

Which offers a 26 tax credit score for methods put in in 2020 to 2022. Beginning in 2023 the credit score will drop to 22. The photo voltaic tax credit score is 26 of the set up price for photo voltaic methods put in in 2020 2021 and 2022.

The typical price of a photo voltaic panel system ranges between 15000 and 25000. Obtain IRS Type 5695 as. 026 18000 – 1000 4420.

Add complete Photo voltaic Tax Credit score Quantity on Line 6. To say the photo voltaic tax credit score youll have to first decide if youre eligible then full IRS kind 5695 and eventually add your renewable power tax credit score data to Schedule 3 and Type 1040. A 30 % tax credit score was accessible for methods put in earlier than December 31 2019.

Evaluate photo voltaic quotes on the EnergySage Market to maximise your financial savings. Web page Final Reviewed or Up to date. All the pieces You Must Learn about On-Grid Photo voltaic Tasks.

Taxpayers who put in and started utilizing a photo voltaic PV system in 2021 and people who begin utilizing photo voltaic in 2022 can declare a federal tax credit score that covers 26 of the next prices. The photo voltaic power methods that qualify for a 26 tax credit score should be positioned into service by December 31 2022. To say the photo voltaic tax credit score youll have to first decide if youre eligible then full IRS kind 5695 and eventually add your renewable power tax credit score data to Schedule 3 and Type 1040.

Details about Type 5695 Residential Vitality Credit together with current updates associated kinds and directions on file. Increasingly more international locations on the planet are selling using solar energy. This kind is for earnings earned in tax yr 2021 with tax returns due in April 2022.

For certified gas cell property see Traces 7a and 7b later. Photo voltaic Tax Credit score Step Down Schedule. The tax credit score was 30 by 2019.

You could possibly take a credit score of 26 of your prices of certified photo voltaic electrical property photo voltaic water. Irs Steering For The Tax Credit score. It is not going to be accessible in 2024 until Congress renews it.

Use Type 5695 to determine and take your nonbusiness power property credit score and residential power environment friendly property credit score. Value of photo voltaic panels. In case your annual tax legal responsibility is 4000 you wont pay any taxes for 2021 in any respect and can owe 1200 much less the next yr 2800.

IRS Type 5695 says No prices regarding a photo voltaic panel or different property put in as a roof will fail to qualify solely as a result of the property constitutes a. The 26 federal photo voltaic tax credit score is obtainable for bought. Along with the credit score kind generally you may additionally have to file Type 3800.

The residential tax credit score is. We go over simply how a lot it can save you with the brand new tax credit score in 2022. The tax credit score stays at 30 % of the price of the system.

In 2018 2019 2020 and 2021 a person could declare a credit score for 1 10 of the price of certified power effectivity enhancements and a couple of the quantity of the residential power property expenditures paid or incurred by the taxpayer through the taxable yr topic to the general credit score restrict of 500. Add the full worth on line 5 of Type 5695. Insert Any Further Vitality Enhancements to Line 2 4.

The Photo voltaic Market Improvement Tax Credit score offers a tax credit score of 10 for small photo voltaic methods together with on-grid and off-grid PV methods and photo voltaic thermal methods. You have to embody IRS Type 5695 together with your. The federal ITC stays at 26 for 2022.

Information to Submitting IRS Type 5695. To say your mission tax credit score when submitting taxes full IRS Type 5695 Residential Vitality Credit. Congress prolonged the ITC in December 2020 offering a 26 % tax credit score for methods put in in 2020-2022 and a 22 % credit score for methods put in in 2023.

Nevertheless the credit will change in just a few years. For instance in case your photo voltaic system prices 20000 you might be eligible for 5200 26 of the full gross price in tax credit score. In the event you use photo voltaic to warmth your house or water heater as an alternative of utilizing electrical energy and gasoline then you possibly can declare 26 % of the photo voltaic system.

In the event you made power saving enhancements to a couple of dwelling that you just used as a residence throughout 2020 enter the full of these prices on the relevant line s of 1 Type 5695. With this value vary in thoughts heres a breakdown of how a lot the 26 photo voltaic tax credit score might allow you to save on a residential photo voltaic system. Step-by step directions for utilizing IRS Type 5695 to say the federal photo voltaic tax credit score.

Type 5695 Directions Claiming The Photo voltaic Tax Credit score Energysage

Photo voltaic Tax Credit score Prolonged 2 Extra Years Sunwork

Why The Photo voltaic Tax Credit score Extension Is A Large Deal In 2020 Energysage

Federal Photo voltaic Tax Credit score A House owner S Information 2022 Up to date

Photo voltaic Tax Credit score Prolonged Via 2022 Choice One Photo voltaic

Photo voltaic Incentives In Utah Utah Vitality Hub

How To Declare The Federal Photo voltaic Funding Tax Credit score Photo voltaic Sam

Federal Photo voltaic Tax Credit score Prolonged Via 2022 Photo voltaic Com

Texas Photo voltaic Incentives And Rebates Obtainable In 2022 Palmetto

How Putting in Photo voltaic Panels Can Assist You Save On Your Taxes

![]()

The Photo voltaic Tax Credit score Photo voltaic Holler

Photo voltaic Tax Credit score 2022 Incentives For Photo voltaic Panel Installations

How To Take Benefit Of Photo voltaic Tax Credit In 2022 Tax Credit Photo voltaic Tax

Photo voltaic Sme Inc How Does The Federal Photo voltaic Tax Credit score Work

What To Know About The Photo voltaic Tax Credit score In 2022 Boston Photo voltaic Ma

How To Declare The Federal Photo voltaic Tax Credit score Type 5695 Directions

Photo voltaic Mortgage Vs Photo voltaic Ppa In 2022 Photo voltaic Mortgage Photo voltaic Firms Photo voltaic

Federal Photo voltaic Tax Credit score Information Photo voltaic Panels Community Usa